APECoin (APE) Plummets, Leaving Holders at a Loss

Key Points:

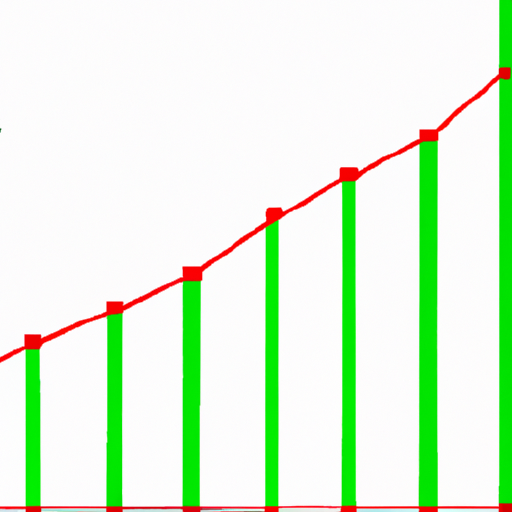

– APECoin (APE) experiences a significant drop of 96% from its peak in April 2022.

– The decline has left most APECoin holders with substantial losses.

– The cryptocurrency market continues to be highly volatile, with investors advised to exercise caution.

It has been a tough ride for APECoin (APE) holders as the cryptocurrency plummeted by a staggering 96% from its peak in April 2022. This sharp decline has left investors with substantial losses and raised concerns about the stability of the token.

The cryptocurrency market has always been volatile, and APECoin’s massive drop serves as a reminder of the risks involved in investing in these digital assets. While the exact reasons behind APECoin’s plunge are unclear, it highlights the importance of thorough research and risk management for crypto investors.

As the name suggests, APECoin was inspired by the popular internet meme involving apes and has gained attention for its unique branding. However, novelty alone could not shield it from the market’s ups and downs. Many APECoin holders were optimistic when the token reached its all-time high in April, but the subsequent crash wiped out a majority of their investments.

It is crucial for investors in the cryptocurrency space to understand that significant price swings can occur within short periods. Cryptocurrencies like APECoin can experience meteoric rises but also face steep downturns. This rollercoaster-like nature makes it essential for investors to assess their risk tolerance and diversify their portfolios accordingly.

While the recent decline of APECoin may leave many holders disheartened, it serves as a valuable lesson in the unpredictable and volatile nature of the cryptocurrency market. As with any investment, it is crucial to approach the cryptocurrency space with caution, conducting thorough research and seeking advice from experts.

The market for digital assets remains highly speculative, and it is advisable for investors to consider their financial goals and risk tolerance before entering. Conducting due diligence and understanding the fundamentals of a cryptocurrency is vital to make informed investment decisions.

APECoin: A Cautionary Tale

The plight of APECoin serves as a cautionary tale for cryptocurrency investors. While some may have been enticed by the meme-inspired branding and perceived hype surrounding the token, the market’s unpredictability quickly turned the situation sour.

The decline of APECoin highlights the importance of conducting thorough research and considering the long-term potential of a cryptocurrency before investing. A solid understanding of the market, fundamental analysis, and risk management are essential tools for navigating the volatile waters of the cryptocurrency sector.

Crypto enthusiasts should learn from the APECoin experience and approach investments with a level-headed approach. It is essential to remember that significant losses can occur within moments in the crypto market, and not all tokens will succeed in the long run.

As the cryptocurrency market continues to evolve, investors must remain vigilant and cautious. While it is possible to make significant gains, it is equally crucial to be prepared for potential losses. Investing in cryptocurrencies should always be approached with a well-informed strategy based on solid research.

Our Hot Take:

The dramatic decline of APECoin showcases the inherent risk and volatility of the cryptocurrency market. While this news may be disheartening for APECoin holders, it serves as a reminder to approach crypto investments with caution and thorough research. It is vital for investors to conduct their due diligence and seek advice from experts to make informed decisions. The APECoin story should remind us that the crypto market is not immune to sudden downturns, and we should always be prepared for potential losses.